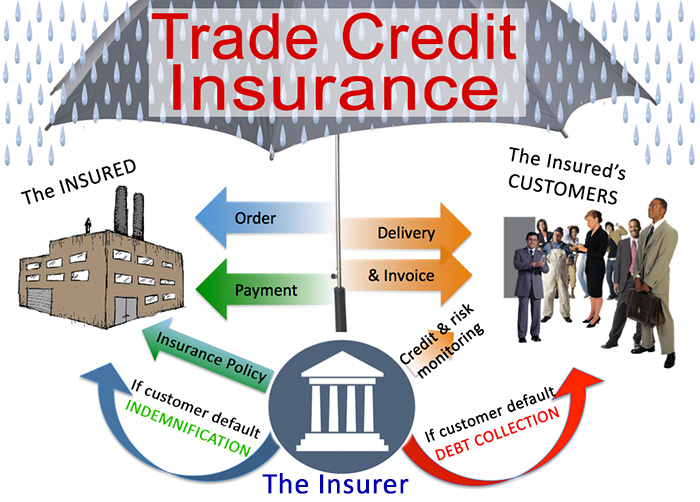

Companies that trade on credit terms with their customers are vulnerable to the risk of bad debts.

Bad debts can be caused directly by the customer’s failure to pay their trade credit debts owed as a result of the customer becoming insolvent, or by failing to pay within the agreed terms and conditions of the transaction (“protracted default”).

But bad debts can also be caused indirectly by the customer’s own customers’ failure to meet their trade credit debts to them.

These financial risks of loss to a business as a result of bad debts can be mitigated by Trade Credit insurance. Trade Credit insurance protects against the commercial and political risks that are beyond the company’s control.

Properly arranged Trade Credit insurance protects a firm’s accounts receivable from losses caused by customer insolvency, protracted default, or political events, and can be structured to the company’s specific requirements, for example:

– a single policy to insure all of the firm’s receivables (a “Whole of Turnover” contract);

– a policy designed to insure only the largest customers or a defined band of customers (“Key Accounts”); or

– a policy designed to insure exposures related to a single customer (“Single Debtor”).

Trade Credit Insurance examples

A manufacturer is operating on a profit margin of 2.5% on a high volume product. One of the buyers of that product defaults on a debt of $100,000. The manufacturer still needs income to meet the ongoing expenses of operating his business:

– Staff costs;

– Operating expenses;

– Supplier costs.

Therefore to make good the loss caused by the default of the buyer means the business has to generate an additional $4,000,000 in sales.

Lesson: Your bills will keep coming irrespective of whether you have been paid.

A brand name supplier of electronic products and components became insolvent. The insolvency event cascaded throughout the distribution chain impacting on over100 suppliers, outsource firms, sub-contractors and logistics companies.

One of those suppliers sub-contracted to you for a component part in their own product. As a result of their client’s insolvency they cannot pay you.

Lesson: You know your customers, but do you know theirs?

As a wholesaler you are turning over $ 50,000,000 on 45 day credit terms. On average your business has over $ 6,000,000 of outstanding debt owed to it at any one time. Your biggest customer generates almost 20% of your sales, and thus creates an exposure to you of $1.2million.

Trade Credit Insurance provides credit limits on all of your major customers allowing:

– your peace of mind on an otherwise unprotected asset;

– as well as increased security for your financiers, lower charges and / or increased borrowings

Lesson: Trade Credit Insurance will help you to sleep well at night.

The Benefits of Trade Credit Insurance

Account receivables are one of the main assets on a company’s balance sheet, and with Trade Credit insurance you protect both your current and future cash flow as well as your profits. You free up company resources to concentrate on more value added activities including new business.

Trade Credit insurance improves the quality of your company’s profitability by:

- providing comprehensive protection against the risk of customer insolvency

- enhancing customer relationships by increasing the level of credit you can allow, and therefore the level of trade, for certain customers

- improved banking relationships and access to finance, because your receivables are insured and which in turn impacts positively on cash flow

- giving you a greater confidence in pursuing further commercial opportunities

Should you consider Trade Credit Insurance?

Do you:

– sell goods on credit terms?

– Wish to grow your business and require security?

– Have concerns about your industry or market trends?

Have you:

– recently experienced a bad debt?

– Just won a significant new client / contract?

Are you:

– refinancing your bank facilities and loans?

– Having cash-flow problems and need assistance with credit control?

– A manufacturer, wholesaler or exporter in:

- Electronics & Consumer Goods,

- Timber & Furniture,

- Chemicals & Building Products,

- Computers,

- Metals & Alloys,

- Paper/Packaging,

- Foods & Agricultural Products,

- Textiles & Carpets?

Or are you:

– a service provider in the fields of:

- Advertising & Marketing,

- Transport,

- Recruitment & Labour Hire,

- Mining & Construction Services?

Answering “yes” to any of the above is a positive sign that you should investigate and consider Trade Credit Insurance.

To learn more

At Trafalgar International we can tailor our trade credit insurance solutions to your company’s size, whether SME or multi-national, sector, and business needs. Please give us a call or schedule an appointment and we would be pleased to get in contact with you.