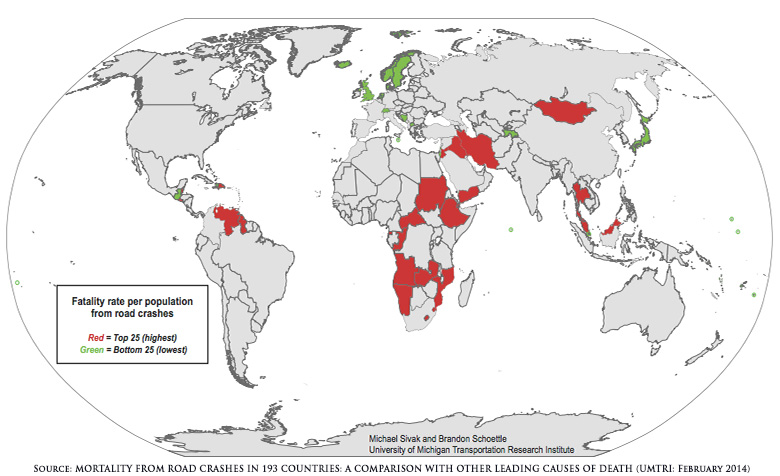

As you go about your everyday affairs, driving in Thailand, you might be interested to know that according to a February 2014 study carried out by the University of Michigan Transportation Research Institute, Thailand has the second highest road crash fatality rate in the world, with 44 deaths per 100,000 population. Namibia ranked highest with 45 deaths per 100,000 while Iran was third with 38 deaths per 100,000 population.

.

Putting these figures into context within Asia, for example, Malaysia has the second highest road crash fatality rate after Thailand with 30 deaths per 100,000 population, followed by Vietnam with 24, China 22, Laos 17, Cambodia 15, Myanmar 10, Philippines 9, Singapore 6 and Japan 5 deaths per 100,000 population.

One only has to read the newspaper headlines during Songkran, or any holiday weekend for that matter, to realise the tragedy of the number of traffic related fatalities in Thailand each year; making things worse, it is believed that the figures are understated as they only represent the numbers of people that die at the scene of the accident.

Comparing some of the daily driving habits and antics of a significant number of motorists with the most common risk factors of lack of application of existing road traffic laws, speeding and drink– driving, along with motorcycle helmets, seat-belts and child restraints not being used, it is perhaps no surprise that the body-count is so appalling.

By now you should already be convinced that there is a greater risk of being involved in a motor vehicle accident here than you are in almost any other country in the world. It is therefore important to ensure you are adequately protected and insured.

Motor Insurance in Thailand

According to the Office of Insurance Commission in Thailand Annual Statistics, the number of compulsory insurance policies outnumbers those of voluntary policies by a factor of more than 3. Why is this significant?

Well, you may be under the impression that compulsory motor insurance provides adequate coverage for injury and damage to another person’s property, much like Third Party insurance does in the UK. The fact is, that it doesn’t.

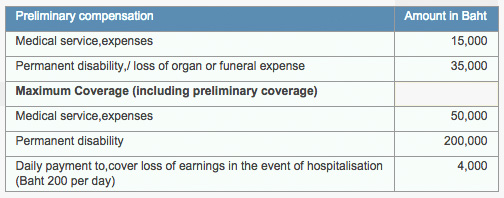

Compulsory Motor Insurance in Thailand only provides cover for accident victims for medical expenses, injury and death but in all cases the level of coverage is woefully inadequate; the provisional coverage for bodily injury would barely cover a night in one of the major international hospitals never mind any treatment that might be required.

The majority of motor vehicles on the road only have compulsory insurance and so you simply cannot rely on other motorists having adequate third party insurance coverage in place. The chances are, if you are unfortunate enough to be involved in a motor accident in Thailand, the only insurance cover that will really matter is your own.

Making sure you are adequately protected

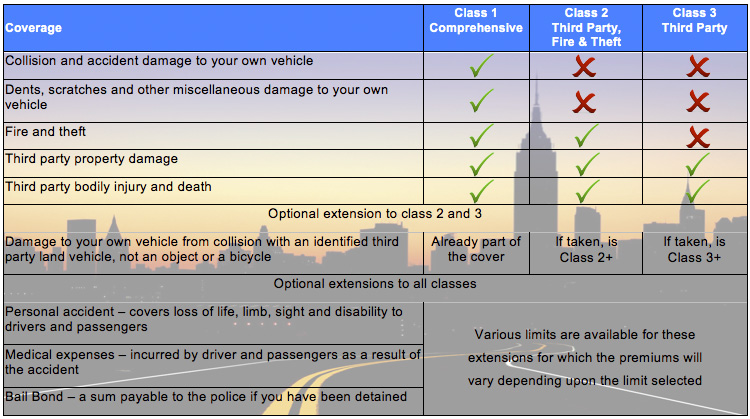

There are 3 basic classes of insurance available and the coverage by these policies is summarised in the table below. You may be interested in watching our video on this subject.

.

The amount of cover may vary from insurer to insurer so check that you are comfortable with the limits being provided. The compensation for medical expenses, for example, on the various policy types is quite low and may not meet your expectations, or what you are used to in your home country.

To make sure you are adequately covered you should really consider taking out additional Personal Accident cover, or better still health insurance, if you have not already done.

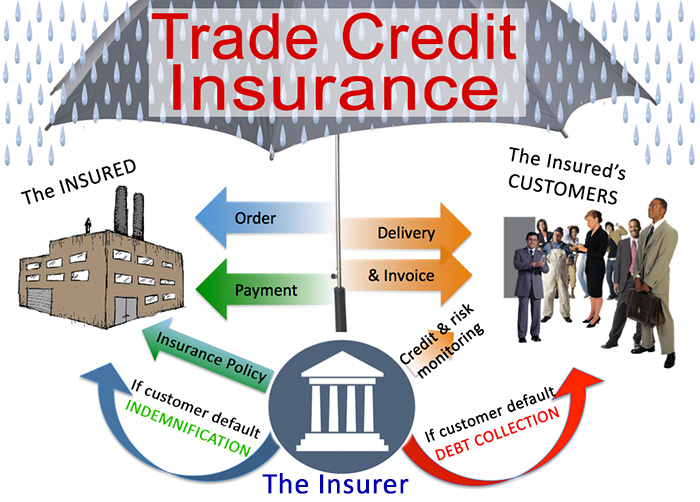

We have insurance professionals that can help you explore all the options for all your personal insurance needs, from driving in Thailand, health and accident policies, or any other class of insurance. And . . . . the great thing is, our expert advice is free.