Protecting the Things that Matter Most

When accidents happen or sudden illness strikes and you are overseas you can be sure that the resulting medical bills will be large, so securing good Health insurance should be a real priority for any expatriate.

Luckily there is a very wide choice of health insurance plans available in Thailand, with premiums varying from a few thousand Baht to tens, and even hundreds, of thousands of Baht per year. Not surprisingly the amount of coverage varies enormously too. The task of selecting the right policy can be a confusing and frustrating one so in this article we are going to try to put forward a few factors that you might want to take into consideration before making a choice.

In the first instance there are 2 basic choices: a local plan offering anywhere from Baht 300,000 to Baht 5 million in coverage; or an international style plan offering Baht 5 million to Baht 80 million and beyond. On the face of things you might think that the international option would tend to be much more expensive than a local health insurance policy, but this is not always true as we will see.

Insure for what you cannot afford!

It’s worth remembering this at the outset. The real purpose of taking out an insurance policy is to protect ourselves financially from what we cannot afford. It’s easy to overlook this when you can purchase insurance for routine out-patient coverage, dental and optical care, as well as things like maternity. These are all very nice to have, but on the whole routine treatment is still relatively affordable in Thailand, and the inclusion of any of these options in any health insurance policy will add substantially to the premium. On the other hand, the healthcare costs associated with a serious accident or illness would put a serious dent in anyone’s savings.

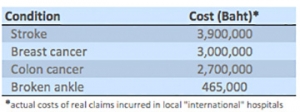

The real cost when things go wrong

So what kind of cover are we talking about here? To give some sense of perspective the following is a table of real claims and the actual costs paid by a local insurance company. They are not exaggerated; in fact they are far from being the highest claims.

There are lots of policies available from local insurance companies that on the face of things can look attractive from a cost perspective, but the old maxim applies – you get what you pay for. And many of the health insurance plans sold in Thailand will not provide sufficient cover for a serious accident or prolonged illness.

Budget is going to be real consideration for most people and international health cover is not cheap! However, it can still make sense from a cost perspective if you choose your options wisely. So, to get real protection without breaking the bank:

Secure good in-patient coverage

The first priority is to select a health insurance plan with good in-patient coverage to provide protection in the event of a serious accident or illness. Make sure your choice of policy includes out-patient cancer treatment under the in-patient plan and that it also allows for good follow-up post hospitalization follow-up treatment.

Thereafter, feel free to add other coverage within your budget, such as out-patient treatment for routine visits to the doctor for coughs and colds, or routine dental perhaps. But under no circumstances do this at the expense of your basic inpatient coverage. If you read a previous article on employee benefits we pointed out that this is the mistake made in a lot of corporate plans in Thailand; they provide cover for something to be consumed in place of real protection for employees. This is why when your company provides you with health insurance it pays to check it carefully as it may not be as all-encompassing as you may have thought.

Do you really need cover for routine coughs and colds?

If the insurer’s standard plan includes routine out-patient treatment, see if there is a discount option if you opt out of the routine treatment. One health insurance gives a 20% discount if you elect not to have routine out-patient cover, but still maintains the provision for follow-up treatment after discharge from the hospital.

Take an appropriate voluntary deductible or excess

Most international insures offer a variety of deducible or excess options. These can be applied per claim, per condition or per annum, depending on the insurer. The monetary excess amounts vary from insurer to insurer but savings of up to 25% are achievable and 40% not unknown.

Opting to take a voluntary excess to reduce your premiums is by far and away a much more sensible option than choosing a cheaper plan with less coverage. At a guess, it will be easier to borrow Baht 15,000 or Baht 30,000 from friends and family to cover the excess than it will to pay a large hospital bill of Baht 500,000, or more, because you are underinsured.

Limit the Geographic Area of Cover/ Area of treatment limitation

Choose an area of coverage that reflects where you spend the bulk of your time. If you choose a good policy there is always provision for some accident and emergency out of area coverage. In most cases this will be sufficient to provide you with cover for those short business trips or annual vacations. You can always supplement your health insurance with some good travel cover which is generally very affordable.

Although not entirely new, there seems to be more plans on the market now offering a wider selection of treatment areas, recognizing that there are countries/regions which have less expensive healthcare costs. For example plans are available which have been specially designed and priced for expatriates living in the “less expensive” countries in Asia, like Cambodia, Indonesia, Laos, Malaysia, Myanmar, Thailand, and Vietnam. By choosing an appropriate area of cover the savings can be quite substantial.

Choose a plan that will allow installment payments

Not really a reduction in premium but it can make things more accessible, and there are a lot of insurers that will offer installment payments to help spread the burden of paying your premium. The options are normally semiannual, quarterly or even monthly.

The choices

In recent years there has been an increase in the number of health international insurers that have taken the time and effort to go through the process of having policies approved and licensed in Thailand by the Thai insurance regulator, the Office of Insurance Commission (OIC). From the insurers perspective this means that they can advertise, promote and sell their policies locally to Thais and expatriates alike. The benefit of all this from the standpoint of the consumer is that there has never been a greater choice, and also, local licensing gives a higher level of comfort because in the event of a dispute about your health insurance there is an independent regulatory body to complain to and seek recourse.

Insurers the world over are famous for their small print and it is no different in Thailand. Before making any decisions you really should get some good independent advice from your insurance broker. It doesn’t cost anymore if you do, but it could cost you a whole lot if you don’t.